CRE Management | What You Need to Know About the Vital Role of a Robust Purchase Order and Budget Approval Process

The complexity of commercial real estate (CRE) management demands sophisticated tools to streamline processes, minimize risks, and maximize returns. Among the essential features of any robust commercial real estate software solution is a well-integrated purchase order and budget approval process.

CRE Management, often referred to as Commercial Property Management, is a specialized branch of real estate management that focuses on overseeing and optimizing the operation, maintenance, and financial performance of commercial real estate properties. These properties typically include office buildings, retail spaces, industrial facilities, and multifamily residential buildings that are used for business purposes.

The primary goal of CRE Management is to maximize the return on investment for property owners and stakeholders. Software solutions, such as ManagePath, have built-in purchase order and budget approval processes to maximize efficiency in operations. In this article, we’ll explore why this functionality is so crucial in the real estate industry.

Streamline Operations

Commercial real estate encompasses a vast array of operations, from property acquisition to maintenance, rent payment, and lease management. These diverse activities require seamless coordination and control.

By incorporating a purchase order and budget approval process into your software solution, you streamline operations and create a central hub for financial activities.

- Simplified Purchasing:

By centralizing purchasing through a software solution, you eliminate paperwork and manual approval processes. This simplifies the procurement process, reducing errors, and providing a clear audit trail for all transactions. - Efficient Budgeting:

Software that supports budget approvals allows you to create and track budgets in real time. It facilitates a more efficient allocation of resources and helps you avoid overspending. - Cost Control:

A robust purchase order and budget approval process enables better cost control, ensuring that expenses align with financial plans and goals.

Enhance Accountability

Accountability is paramount in the commercial real estate industry. Investors, property owners, and stakeholders need assurance that their resources are being managed responsibly. A comprehensive software solution with purchase order and budget approval functionality offers several benefits in this regard:

- Audit Trail:

Every financial transaction leaves a digital trace in the software. This transparency enhances accountability by allowing for thorough audits and financial accountability checks. - Authorization Levels:

The software can define and enforce authorization levels for different roles within the organization. This ensures that only authorized personnel can approve purchase orders and budgets, reducing the risk of unauthorized or inappropriate spending. - Compliance:

The real estate industry is subject to various regulations and standards. A software solution with a built-in approval process helps ensure compliance with these rules, reducing legal and financial risks.

Risk Mitigation

Managing risk is a critical aspect of CRE management. With a robust purchase order and budget approval process in place, you can mitigate various types of risk:

- Financial Risks:

Overspending or unauthorized expenses can lead to financial instability. By having a controlled and monitored purchase order and budget process, you minimize the chances of financial risk. - Operational Risks:

Inefficient procurement processes can lead to operational bottlenecks, which can affect tenant satisfaction and property performance. Streamlining these processes through software minimizes operational risks. - Legal Risks:

Non-compliance with industry regulations can result in legal complications. A software solution that helps ensure compliance reduces legal risks and potential liabilities.

Cost Reduction

Commercial real estate management involves substantial costs, and every dollar saved contributes to the bottom line. A purchase order and budget approval process integrated into your software solution can lead to significant cost reductions:

- Reduced Administrative Costs:

Automation and streamlining of processes reduce the administrative overhead associated with manual approval workflows and record-keeping. - Preventing Unauthorized Spending:

Unauthorized or excessive spending can quickly erode profits. Automated approval processes help prevent these issues, saving money in the long run. - Resource Optimization:

By closely monitoring budgets and expenses, you can identify areas where resources can be optimized or reduced without compromising property performance.

Make Data-Driven Decision

In the commercial real estate industry, data-driven decision-making is becoming increasingly important. A software solution with a robust purchase order and budget approval process generates valuable data and insights:

- Historical Data:

The software records all financial transactions, creating a rich database of historical data. This data can be leveraged to make informed decisions regarding future budgets and resource allocation. - Performance Metrics:

Tracking approved budgets and their actual expenditures provides insights into the performance of properties and the efficiency of resource utilization. - Forecasting:

With accurate historical data, you can make more precise forecasts, helping you plan for the future and identify potential cost-saving opportunities.

Stakeholder Confidence

Commercial real estate is often a collaborative effort involving multiple stakeholders, including property owners, investors, and tenants. A well-integrated purchase order and budget approval process contributes to stakeholder confidence in various ways:

- Transparency:

Stakeholders can access and review the financial data, budgets, and approvals, fostering trust in the CRE management process. - Communication:

The software streamlines communication between stakeholders, enabling faster decision-making and problem-resolution. - Risk Management:

Stakeholders are more likely to invest in or lease from a property management team that demonstrates robust risk management through a comprehensive software solution.

Scalability

As a commercial real estate portfolio grows, the complexities of managing properties increase exponentially. An efficient software solution with purchase order and budget approval capabilities can scale along with your business:

- Adaptable Workflows:

You can configure the approval processes to match the specific needs and complexities of your property management operations. - Multi-Property Management:

Easily manage multiple properties with a unified software system, ensuring consistency in financial operations across your portfolio. - Integration:

Integrate your software solution with other essential tools and systems, such as accounting software, to create a seamless, end-to-end property management ecosystem.

Competitiveness

In the competitive commercial real estate landscape, efficiency and cost-effectiveness are differentiating factors. A software solution with a robust purchase order and budget approval process can give you a competitive edge in several ways:

- Faster Decision-Making:

Accelerated approval processes mean you can act swiftly on opportunities and address challenges more effectively. - Cost Control:

Better financial management and control lead to cost savings, which can be passed on to tenants or reinvested for property improvements, making your properties more attractive. - Stakeholder Attraction:

Investors and tenants are more likely to choose property management teams that demonstrate efficient and accountable financial practices.

ManagePath Budget Approvals Process for CRE Management

ManagePath provides end-to-end software that handles every aspect of capital project management, including budget approval systems.

Our budget approval system allows users to:

- create budgets

- track purchase orders

- approve change orders in real-time

Users can create budgets, incorporate funding, and set up an approvals system based on steps, roles, and amount thresholds.

Upon creating a contract, certain users can:

- add in costs to the purchase order

- approve funding of the purchase order

- allocate payments of the purchase order

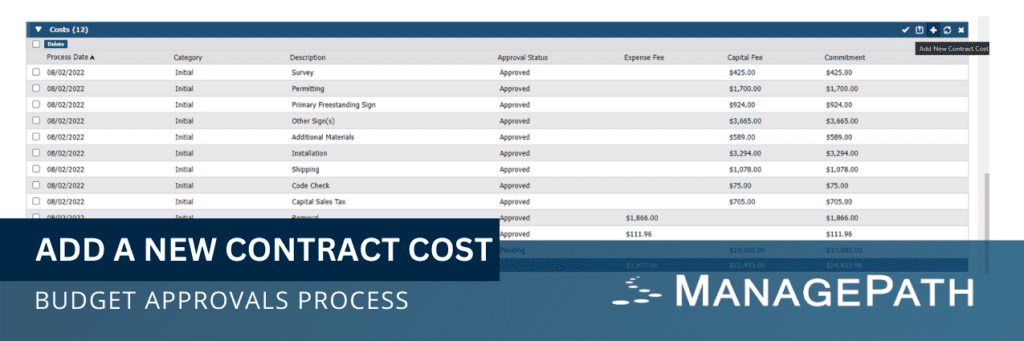

Users can add in cost by clicking the ‘+’ sign to add a new Contract Cost

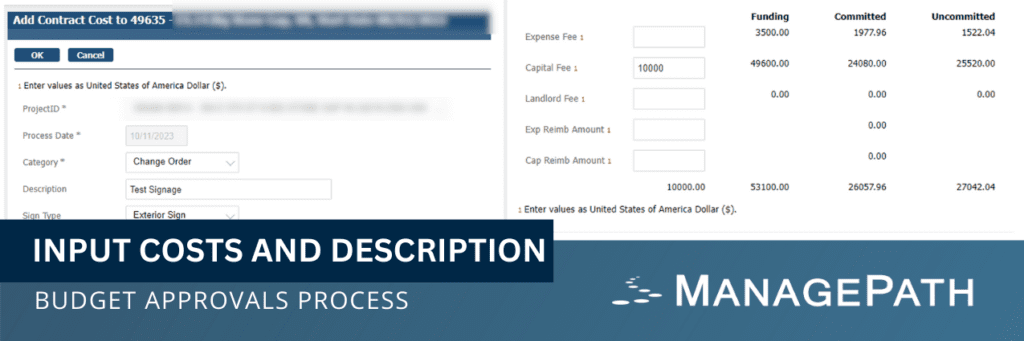

They can input the fees of the cost and add in a description.

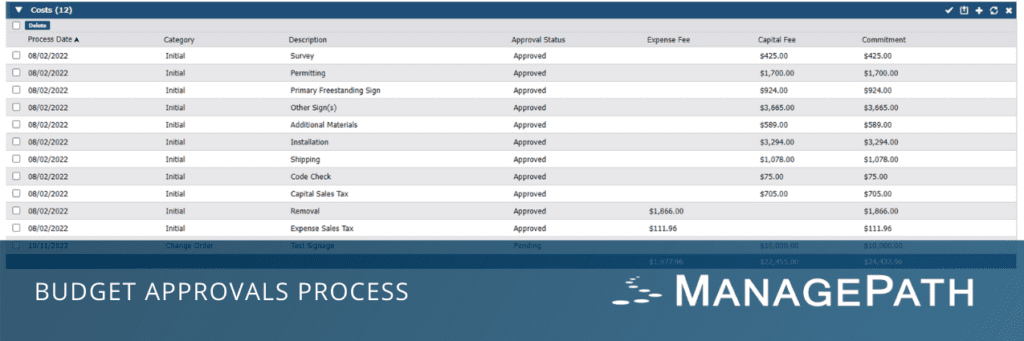

The line item will be added to the cost module.

The amounts are then allocated to a certain responsible party which is defined by a matrix during implementation of this module.

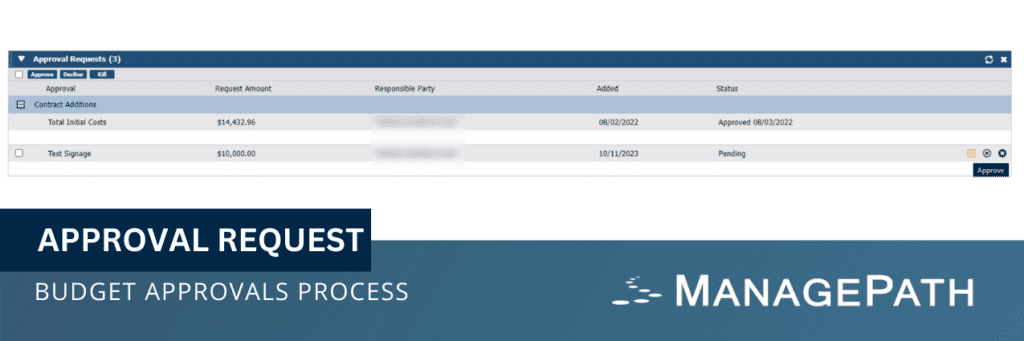

On the Approval Request module, the assigned user will then have the 3 options:

- Approve

This will approve the funding amount. - Decline

This will decline the request but the request will still be active allowing the user who created the request - Kill

This will decline the request but not allow the user to make adjustments to the request.

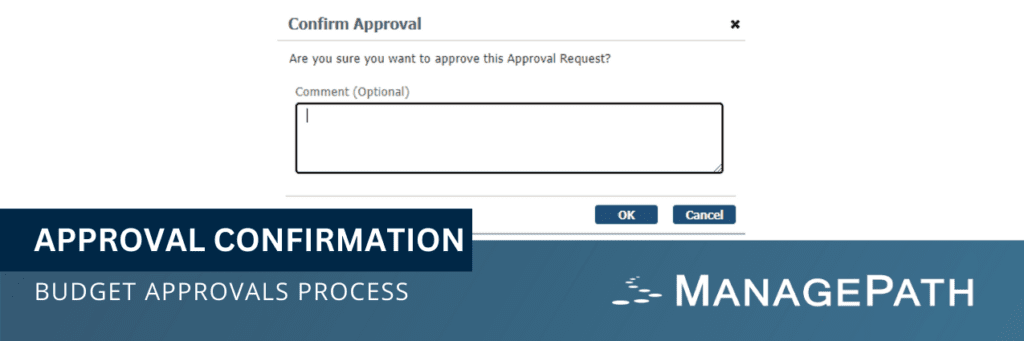

After clicking approval, a prompt for an approval will be made.

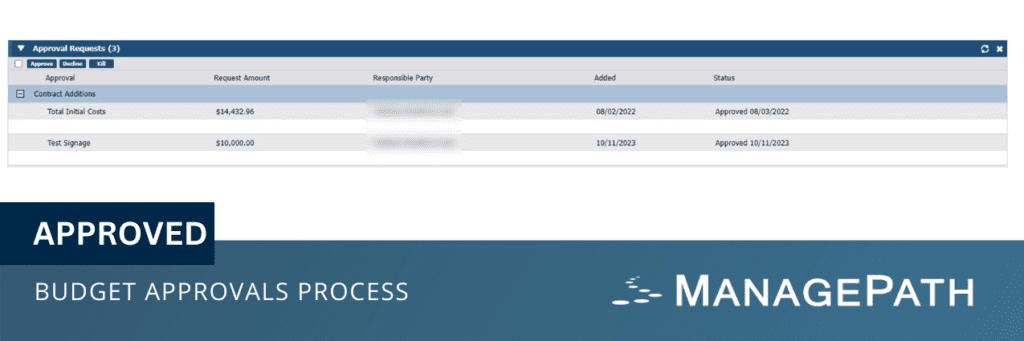

Then the approval will be applied and then displayed as approved in the approval requests module.

Conclusion

A robust purchase order and budget approval process integrated into a commercial real estate software solution is not merely a useful feature; it’s a critical component for success in the industry.

No matter your role, investing in a comprehensive software solution with these capabilities is an investment in the future success of your commercial real estate endeavors.