Accounting Modules That Meet Real Estate Needs

Be assured that you’re compliant with new requirements long before the required due dates.

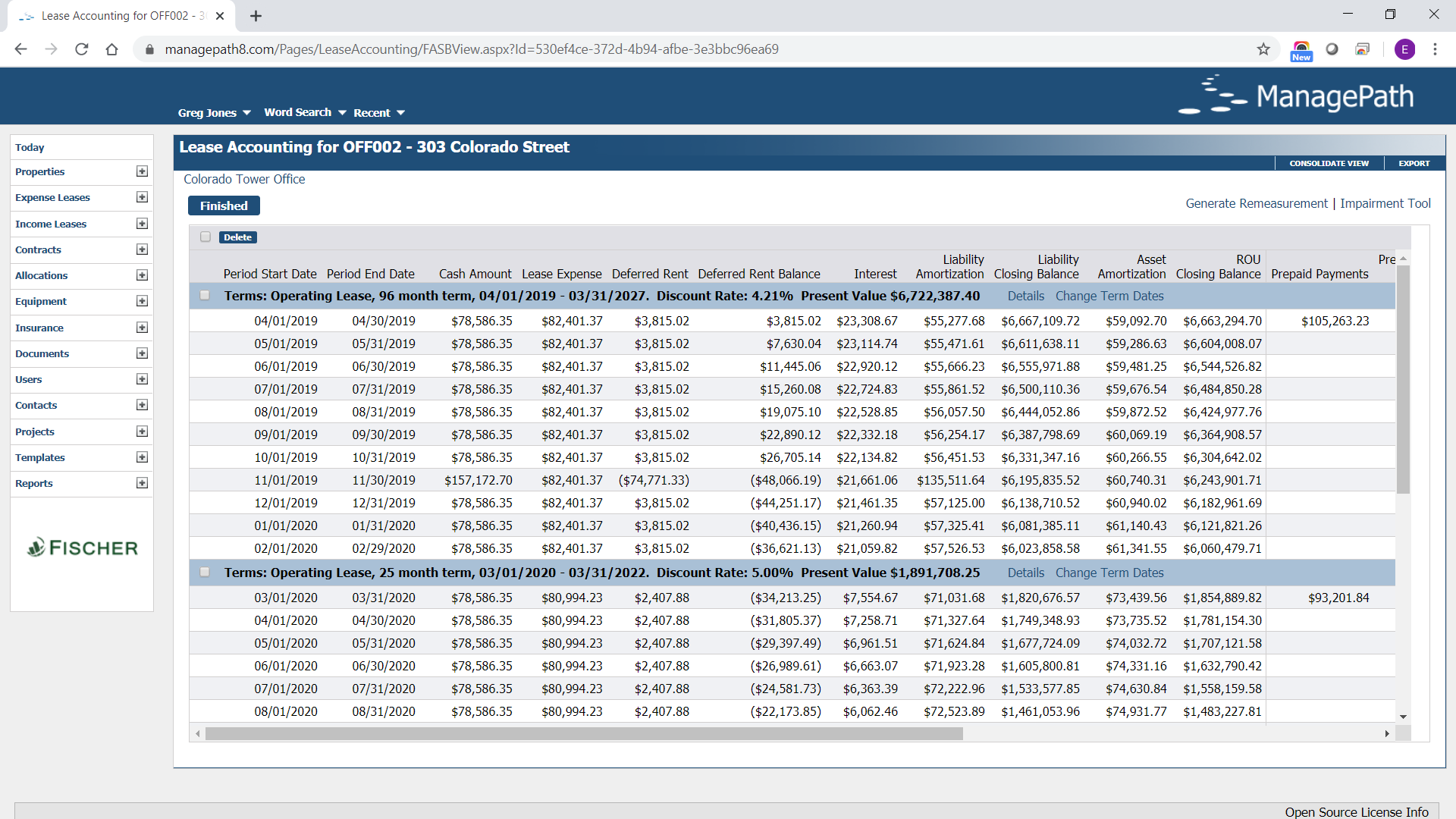

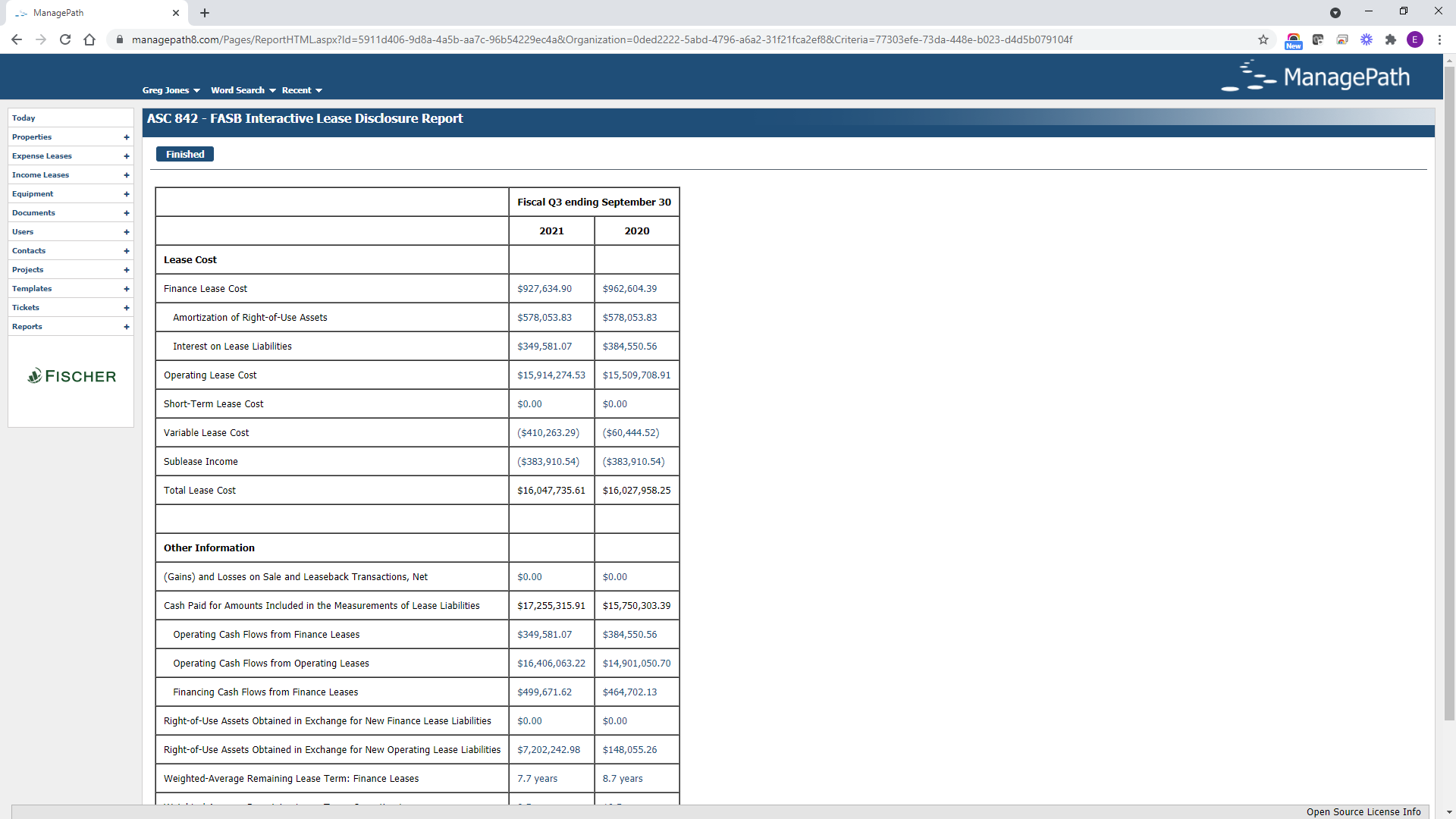

ManagePath has been reconfigured and updated to include advanced functionality that will enable you to bridge the gap between standard accounting systems and the specific needs of your real estate department, working with the new FASB / IASB / GASB regulations. Fischer’s Lease Accounting modules facilitate ASC 842, IFRS 16 and GASB 87 compliance by:

-

Providing standardized reports correcting the errors and manual manipulation requirements inherent in spreadsheets

-

Automating operating vs finance lease type testing

-

Generating journal entries with out-of-the-box reporting

-

Calculating the correct impact for impairments, remeasurements, and modifications for leases

-

Flagging leases updated by real estate for accounting review