ASC 842: Keeping a Lease on the Balance Sheet

If you are not using lease administration software, managing your business’ financial documents can often be difficult to navigate. The GAAP (generally accepted accounting principles) rules and regulations implemented by the Financial Accounting Standards Board (FASB) and the U.S. Securities and Exchange Commission (SEC) are constantly evolving. One of the most tedious tasks is categorizing your leased assets and liabilities to determine if they will be included on your balance sheet or added to your list of “off-balance sheet” (OBS) items.

The Balance Sheet Breakdown

You might be asking, “What exactly is a balance sheet/off-balance sheet, and what does it do?

A balance sheet is a snapshot of the current financial state of a company. It is calculated by using the shareholder equity, liabilities, and assets. When provided to a bank or investor, they can determine where funding will be allocated as well as gauge the potential for financial growth and sustainability.

An off-balance sheet is a list of assets or liabilities that do not appear on a company’s balance sheet. OBS items are typically not owned or a direct obligation of the company, however, they are still assets and liabilities.

Keeping your company’s balance sheet and off-balance sheet up-to-date and, well… balanced, is critical when it comes to reporting and evaluating your business. At Fischer Solutions, we aim to give you the lease administration tools and support you need to have confidence in reporting your financial documents accurately.

The Rules and Regulations

In 2015, FASB found that 85% of leases were not being reported on balance sheets, which meant banks and investors could not determine the true financial status of the company being evaluated. Thus began a full-on migration for the way lease accounting was reported.

In 2019, FASB issued Account Standards Update, ASC 842, which targeted off-balance sheets directly. FASB stated:

“A lessee is required to recognize assets and liabilities for leases with lease terms of more than 12 months.”

FASB, ASC 842

What types of leases does this update apply to?

- Real Estate

- Equipment

- Automotive

- Technology Hardware (servers, laptops, copiers, etc.)

You will enter, assess, and manage each lease to ensure it gets classified correctly. In an attempt to achieve more transparency and comparability in financial reporting, you will capitalize all leases and report them on the company balance sheet as either a Finance or Operating lease… more to come on that, later.

Moving forward, any lease administration software you use will:

- Capture and manage the data to guarantee compliance and optimize your business strategy.

- Quickly migrate the essential data of each lease, catalog it accordingly, and manage it correctly.

- Be easily accessible.

Fischer Solutions’ lease administration software is built to ensure that all regulations are met, with room for updates as the SEC and FASB continue to evolve.

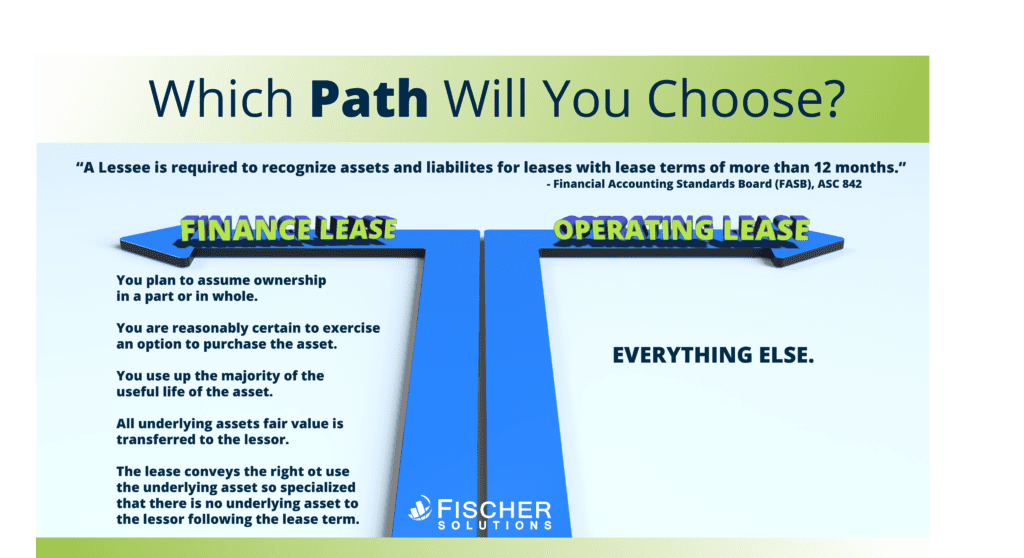

Finance Lease vs. Operating Lease: Which Path Will You Choose?

Now, you assess every lease to decide if it is more akin to a rental or finance, and based on that determination, classify each as either an operating lease or a finance lease. Leases with terms greater than 12 months (which are most real estate leases) are recorded as a right of use (ROU) asset, because you derive a “benefit” from using something. However, your future stream of lease payments will be treated as a lease liability on the balance sheet.

The Difference Between a Finance or Operating Lease

Let’s start with the finance lease because it’s easier to grasp the concept. If you intend to use up all the value of the asset – so that you just about own it by the end of the lease term – then it’s a finance lease.

It is a finance lease if:

- There is a plan for you to assume ownership of the lease in part or whole.

- You are reasonably certain to exercise an option to purchase the asset.

- You use up the majority of the useful life of the asset.

- A consideration representing substantially all the underlying assets fair value is transferred to the lessor.

- The lease conveys the right to use the underlying asset so specialized such that there is no alternative use for the underlying asset to the lessor following the lease term.

So what is an operating lease? Everything Else.

In the simplest terms, any lease with a term greater than 12 months that doesn’t meet the finance lease criteria above is an operating lease. If the term is less than 12 months, forget about it.

Fischer Solutions’ proprietary lease administration solution, ManagePath™, automatically figures this out for you! It calculates interest expense on the lease liability, amortizes the expense of the ROU asset, and puts them right where they belong on the income statement.

Decisions, Decisions: Timing and Intention of Your Leases

It is imperative to recognize your new assets and liabilities using the present value of the lease payment discounted by the company’s borrowing rate, plus adjusted initial direct costs or improvements.

Present value of lease payment

– Company’s Borrowing Rate

+ Adjusted Initial Direct Costs/Improvements

Calculating the time frame of your new assist is simple, it is just the term of the lease. However, there’s a catch:

- When did the lease commence?

- When was it renewed?

Precision is key and could mean backdating everything to the date of your renewal even if your escalation doesn’t occur until some later date.

Furthermore, if you are reasonably certain you are exercising an option to extend the lease, then you figure the expected escalation and additional lease extensions into the calculation.

Reasonable Certainty! Are you reasonably certain about anything in business these days? You might be, if you are a retail store in the perfect location, or if you’ve installed expensive medical or factory equipment that would be difficult to move. In other words, if you stay put, your leases and the option to renew are lumped together and you’ve got a long-term asset on your balance sheet. But if there is a reasonable likelihood that things might change, there are other factors to consider.

This grey area can be confusing, but there are lease administration tools to help make this more manageable. Your best path to take is ManagePath™.

Interpreting the FASB Fine Print

Aside from the hassle of upending accounting practices that have been in place for years, you also must consider the following:

1. “To own or lease: that is the question.”

If you are accounting for the leased space on the balance sheet anyway, why not own the asset? Well, primarily because in most cases this just isn’t practical, or not deemed an efficient use of capital. But under certain circumstances, it might be a consideration, such as:

- a cash-rich company

- a company with investment-grade credit

- companies preparing to sell or be acquired

- companies that know this as a key strategic long-term facility, etc.

2. Is a bargain really a bargain?

So, you’ve negotiated great terms on your renewal option? Maybe, or maybe not. What seems like the deal of the century may just trigger the “reasonably certain” clause – 100% certain to be included on the balance sheet for all time – and just like that, you bought yourself a finance lease, which may not be what you intended to do.

3. Landlord Build-Outs or Balance Sheet Busts

You have expensive taste and want that “wow” factor when clients enter your office. The landlord is happy to accommodate you with generous improvement terms. Time to break ground, right? That depends.

Tenant improvements that get amortized and rolled into the lease, like landlord build-out allowances – must be accounted for differently and could trigger a change in the value of the lease. You must examine a variety of financial scenarios to strike the right balance between negotiating a landlord allotment or paying for improvements yourself.

4. Add a lease, lower your return on assets?

Unless you are preparing for a sale of your company, banks and investors alike place a high premium on companies that generate the most income from the least amount of fixed assets.

Now that leases are on the balance sheet, the playing field is leveled, but the treatment of lease accounting can still impact many measures affecting credit rating such as debt to equity, debt to coverage, and so on. As a result, corporate real estate strategy becomes even more important to the CFO than it did in years past.

Your lease administration software needs to report deeper analytics on both current leases and new ones, running models on how FASB changes the overall financial landscape. It’s time to “FASBe Proactive”.

Our Solution to Help You Balance the GAAP

Fischer Solutions is way ahead of the FASB curve, developing systems, processes, and data collection and analysis tools that manage lease administration effectively. Though we built a company that has saved our clients billions of dollars and countless sleepless nights, there has never been a time when we are of greater help.

Fischer Solutions prides itself on always proactively addressing new regulations and their consequences. Historically, we’ve been early providers of solutions to:

- Automate the creation and maintenance of GAAP schedules for rent payments.

- Implement SOX-compliant processes and controls.

- Provide a highly secure, auditable processing environment fully compliant with SSAE 16.

We’ve got you covered through a combination of insight, knowledge, expertise, and ManagePath™. We’re not only your advocates; think of us as your FASB lease administration experts.

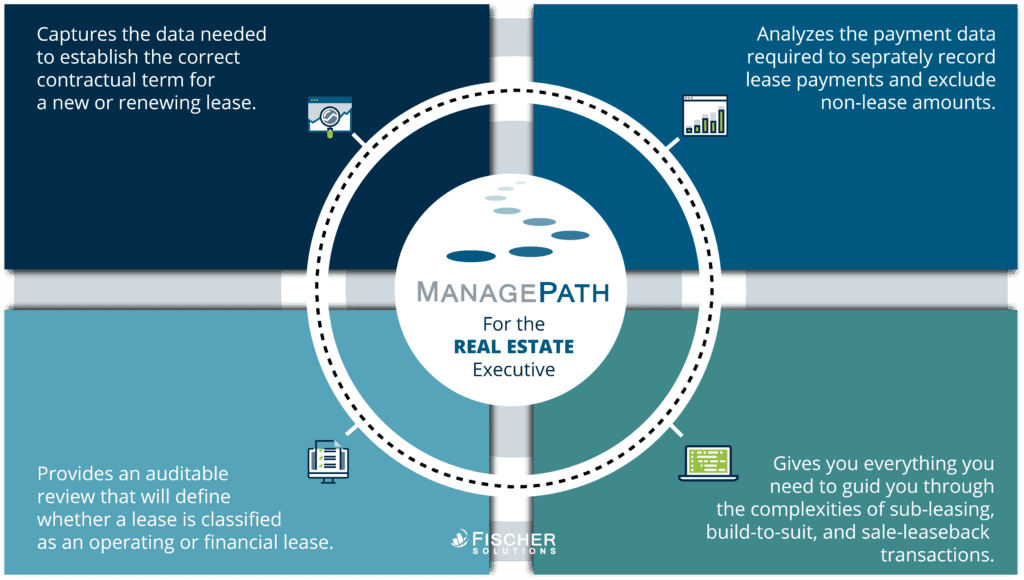

Get on the Path: ManagePath™ Explained

There is no better, easier-to-implement, or more user-friendly solution to comply with FASB and manage your lease administration and project management needs than ManagePath™.

It’s not just software. It’s your secret weapon.

For the real estate executive, ManagePath™:

- Captures the data needed to establish the correct contractual term for a new or renewing lease.

- Analyzes the payment data required to separately record lease payments and exclude non-lease amounts.

- Provides an auditable review that will define whether a lease is classified as an operating or financial lease.

- Gives you everything you need to guide you through the complexities of sub-leasing, build-to-suit, and sale-leaseback transactions.

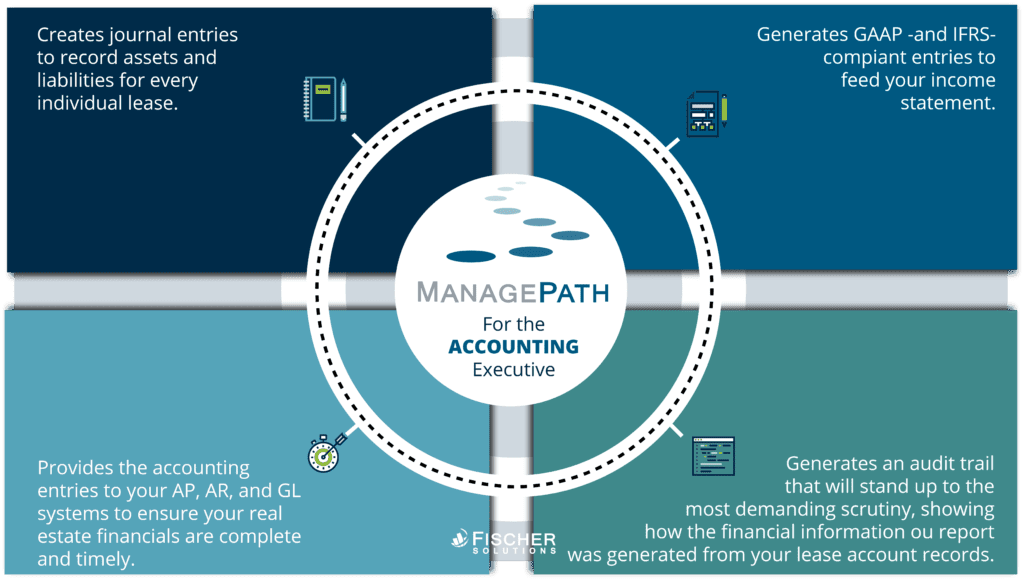

For the accounting executive, ManagePath™:

- Creates journal entries to record assets and liabilities for every individual lease.

- Generates GAAP- and IFRS-compliant entries to feed your income statement.

- Provides the accounting entries to your AP, AR, and GL systems to ensure your real estate financials are complete and timely.

- Generates an audit trail that will stand up to the most demanding scrutiny, showing how the financial information you report was generated from your lease account records.

Conclusion

It may seem daunting at first. At the very least, it is certainly distracting.

Your Fischer Solutions team has the experience, resources, knowledge, and technical know-how to calmly guide you through this regulatory crossword puzzle smoothly, efficiently, and with minimum effort on your part… from beginning to end.